Why did my Flood Zone Change and what do I do about it?

Your flood zone changed because FEMA updated your flood map due to natural and man-made events that occur over time. FEMA flood map updates are published 26 times a year and could cause you to pay higher or lower insurance premiums, pay insurance for the first time, or remove the insurance requirement from your property. You cannot stop a flood, but you can rebuild your life afterward when you are insured by the federal government or a private market policy that your loan servicer must accept.

You are established in your property for years or operated your business knowing what the flood zone is and you are insured as you should be and compliant with all the regulations. Flood insurance can seem like a set-it-and-forget-it type of thing. Reality – your flood situation is constantly changing.

One day, seemingly out of nowhere, your mortgage servicer, or maybe your insurer, or even a community official, or maybe a postcard in the mail says your FEMA flood zone changed and now you have to do something that you thought was already taken care of. Is this a scam or can flood zones really change?

Do flood zones really change?

Yes, flood zones change. It is not a scam and it happens all the time. Every 2 weeks in fact. FEMA is constantly updating their floodplain maps to try and keep them as fresh and up-to-date as they can with the budget Congress gives them.

Why do flood zones change?

Over time, new development in the community, or better scientific data, or better topographic contour data, or just streams moving around and beaches changing cause the flood zones to move around too. It’s not something FEMA is doing to you, it’s a simple combination of nature shifting herself around and humans altering nature so we have a place to hang our hat and FEMA is trying to keep up to make the maps reflect what is currently happening in your community.

How do the flood zone maps change?

Every two weeks, FEMA releases a new batch of flood maps that replace the old maps. Therefore, eventually, your map will be replaced with a new one. About a year before FEMA publishes a new map, they give a draft to your community so you can comment on it and even protest it if you want. Officially, that draft is called a Preliminary Map and you can even see them on FEMA’s Map Service Center (https://msc.fema.gov) website and FEMA usually holds a meeting in your community to take questions about the maps. If there are no protests to the Preliminary Map, FEMA will create a notice in the Federal Register 6 months before Preliminary Maps become your new map so there is another chance to be aware and get ready. When the notice is published, that map is officially called the Pending Map. And in the Federal Register notice, FEMA will provide what they call the Effective Date, and that’s the date when the new map is official (and then called the Effective Map) and your old map is no longer valid and your zone can officially change, for better or worse.

So, 26 times a year, somewhere in the USA, a community receives new flood maps and some of the flood zones are changing. FEMA has used this process for years, but it is unlikely to be something most people think about until they are told their flood zone changed.

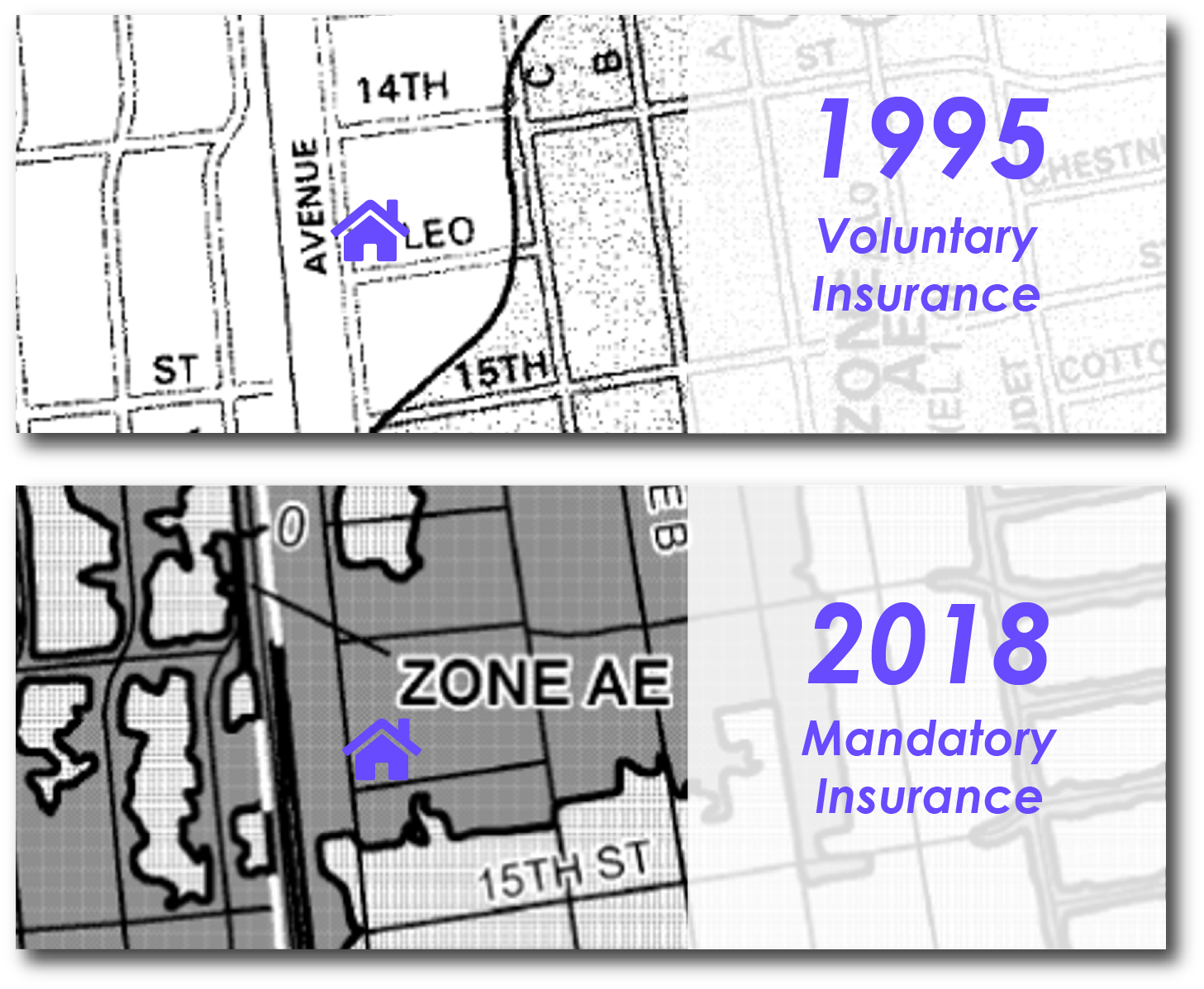

Every property has a flood zone designation (see our blog about creating 142 million flood zones for the Nation) and that zone sets your flood insurance rate and makes the insurance either mandatory or voluntary. So, when the maps change you could either pay a different insurance premium (either higher or lower) and insurance could change from mandatory to voluntary or vice versa.

What do I have to do if my flood zone changed?

If you were required to purchase flood insurance but now you are not… keep your flood insurance policy. Yes, you can drop your policy since it is now voluntary, but we would not recommend that. In this scenario, the flood zone lines shifted a little bit around your property, which benefited you, but Mother Nature doesn’t read maps so the flood risk is still close to your property and the insurance is cheap if you aren’t required to have it. You still have a good chance of seeing some flood damage, but you got lucky and are not required to buy it anymore. Look at this as a major insurance premium discount rather than dropping the policy. (we don’t sell insurance; we’ve just been doing this a long time and have seen the destruction to uninsured properties). Moving from a mandatory situation to a voluntary insurance situation doesn’t mean you are safe; it just means you aren’t on the mandatory list anymore.

If you were not required to purchase flood insurance but now you are, then we feel your pain but the federal mandatory purchase line really is a reasonable minimum standard so you really are at a heightened risk of being damaged by a flood. You can’t stop the flood, but you can get money to rebuild your life after it. Talk to your property insurance agent and they can either set you up with a policy or they can direct you to a flood insurance specialist that can. Flood insurance is a separate policy from your homeowner’s policy, so this a whole new thing you must do. And you might need to buy an Elevation Certificate (see our website explaining what that is) and you can maybe change the map with a LOMA (again, see our website). And don’t think you can just ignore this. The mortgage servicers are required by law to make sure flood insurance is in place, and they will make sure, so get in front of it.

Also, be sure to check out your private flood insurance options. Even though FEMA says you are required to buy flood insurance, you do not have to buy an insurance policy from the federal government. You can buy an equivalent policy (and often, one with more protection) from private insurers. Just search the Internet for “private flood insurance” and you will find companies offering these policies. In 2019, the insurance rules changed, and your mortgage servicer must now accept a private flood insurance policy to satisfy the federal mandatory purchase requirement so there’s no reason to not shop around.

It’s not my fault the zone changed, so don’t I get some relief?

Yes, you do. If the map changed within the last year of the map’s Effective Date, and now you are required to buy flood insurance for the first time, FEMA gives you a special discounted insurance premium called “Newly Mapped”. You will not pay the full premium in your first year of insurance and your premium will slowly rise up to the full rate over a number of years so you can ease into it and have time to make decisions. There are other special FEMA discounts your agent can guide you through if you qualify, so just ask.

Please reach out to us if you need support for a recent flood zone change. We're here to help.

Stay safe,

Josh