Save $1,000,000+ in Flood Insurance Premiums!

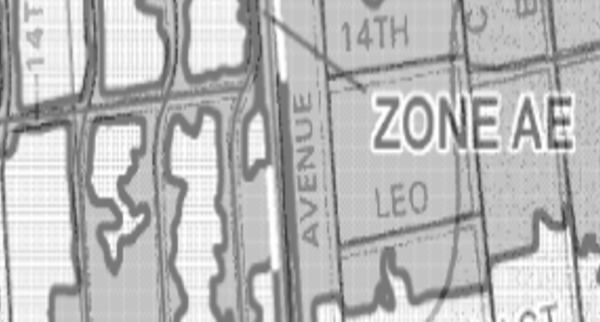

Commercial flood insurance can be expensive—very expensive. So, what should you do if your property is in a FEMA-designated Special Flood Hazard Area (SFHA) and your lender says, “you have two options, get flood insurance or a get a LOMA.”

Of course, you can explore your options for obtaining flood insurance through the National Flood Insurance Program (NFIP) or Private carriers. But if you’d like to remove the mandatory purchase requirement altogether, there’s a two-step approach I’ll discuss here. I’m Eric Ratcliffe, the former Director of FEMA’s Letter of Map Amendment (LOMA) Program and current COO at MassiveCert.