Is My House in a Flood Zone? Search FEMA Flood Map by Address and So Much More

The following article by Julia Weaver of Redfin is reposted to MassiveCert.com.

August 25, 2021 by Julia Weaver

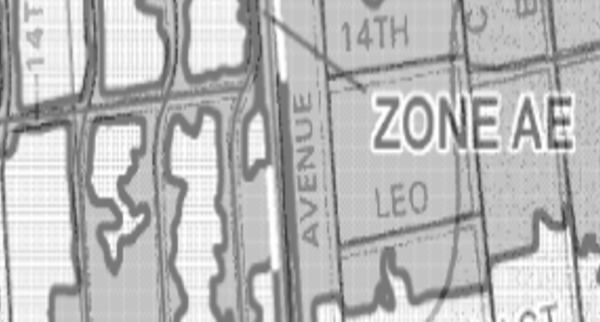

Considering all that’s happening with climate change and the potential risk it brings to homeowners, you may be wondering if your house is in a flood zone. Whether you are a first-time homebuyer, looking to sell a vacation home, or simply a homeowner looking for some answers, you have the right and responsibility to find out.