MassiveCert Press Release re: 142 million

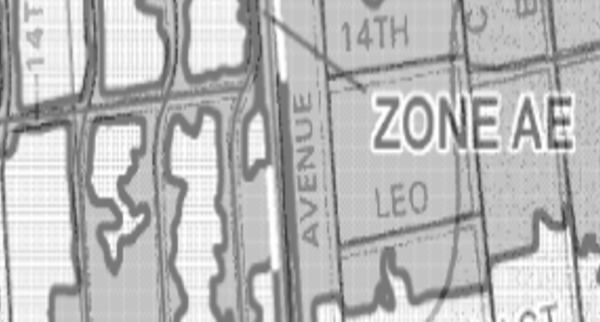

MassiveCert aims to make every American aware of their own personal flood risk so they can make informed decisions. Through a partnership with First Street Foundation, we released FEMA flood zone date for 142 million properties nationwide.